Brexit and The Effect on European Equity Markets

Three months after the result of the Brexit vote, and a month after the Bank of England’s reaction, cutting rates and adding stimulus, TradeTech conducted a survey of equity market participants to canvass their opinions as to how the changes and challenges will specifically affect their businesses.

The overall flavour of the responses is of cautious optimism, though there appears to be a reluctance to expand while uncertainties remain.

Since the survey, Prime Minister Theresa May has announced a deadline for Article 50 to be triggered, and though this is unlikely to have changed many respondents’ answers, the Bank of England rate cut and stimulus at the beginning of August may have influenced some. There is still much uncertainty as to the details to be negotiated and for some respondents, there were questions that required more considered responses, which could not be answered with definite a ‘yes' or ‘no’.

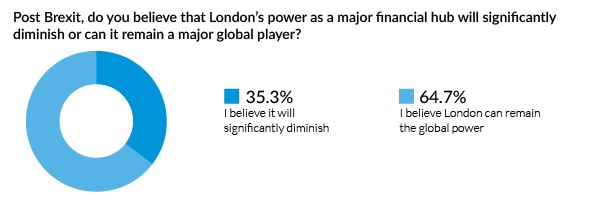

The responses to five key questions put to professionals from the buy-side, sell-side, exchange, and tech sectors, showed a cautious confidence in London’s financial future, though there appears to be a reluctance to engage in long term investment, notably in employment. When asked if London would retain its power as a major financial hub, or would find itself diminished after de-coupling from the Union with continental Europe, a confident majority of 64.7% believed London would retain its position.

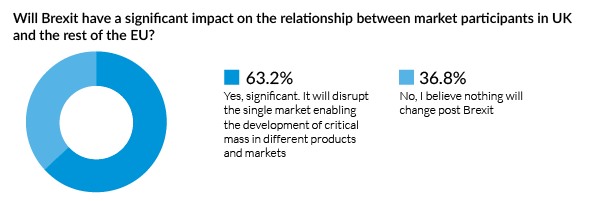

An almost equal number expect there to be some impact on the relationships between UK and other EU market participants, with 63.2% (but, markedly, 82% of the exchange sector) expecting a definite affect from the decision, which is understandable, but it must be hoped that the desire to forge and maintain effective business relationships will enable all to overcome any differences that might arise.

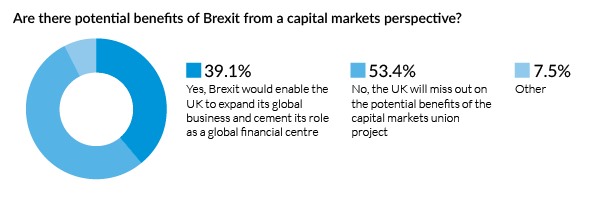

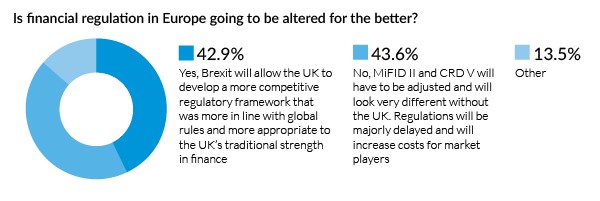

There is a balanced response concerning financial regulations in Europe, potentially reflecting the general feel of uncertainty surrounding MiFID II, and why investment is expected to be largely focused on upgrading technology over the next two years. This is reflected in the question that asks whether there will be any potential benefits from Brexit from a Capital markets perspective, as 39.1% expect the UK to expand its global business, while 53.4% expect the UK to miss out on the potential benefits of a capital markets union project. Though some felt they could still expand business and cement London’s position globally, others felt that it was either premature to say, or that there would be a combination of benefits and disadvantages.

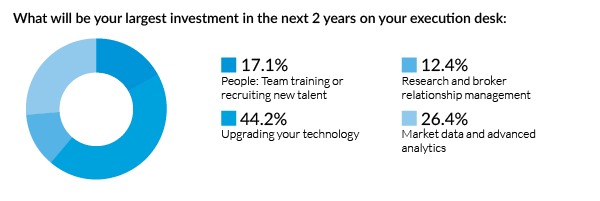

The question as to whether financial regulations in Europe were going to change for the better drew predictably divided feedback; as many felt that there might be additional costs and delays as felt that Brexit will actually allow the UK to develop more competitively, whilst some just felt that either it was really too early to tell, or that the eventual result would be a mix of both pros and cons. A little over half of those surveyed felt the UK will miss out on the potential benefits of the capital markets union project, which was the gloomiest response to any of the questions posed, and potentially why only 17% plan to invest in people and 12% in research and broker relations, while 44% expect to invest in technology.

Businesses are preparing to invest to be able to face the challenges ahead, with almost half saying their largest investment would be in technology (though not the tech sector, which favoured market data and advanced analytics); this is doubtless to be able to manage the regulatory changes.

TradeTech's survey results show a snapshot of the hopes and concerns held by London’s financial markets, generally and it may be many months yet before a more definite picture of the true shape of Brexit can be formed. Concerns around the changes in regulations appear to be the greater concern, along with potential costs, which may hinder further expansion, as 43.6% believe Brexit will result in costs and delays, while the same number believe Brexit will allow the UK to develop.

Keith Grindlay

Mobile 07787 508161

KGrindlay@macrothoughts.co.uk

Disclaimer: Macro Thoughts are a commentary, not investment research or advice – they are for information only and should be regarded as unregulated by the Financial Conduct Authority. While several people have my agreement to forward Macro Thoughts, I would appreciate being contacted first.

Macro Thoughts is independently researched and produced by Keith Grindlay, drawing on his considerable experience in Fixed Income, Bond, Forex, Commodity and Equity Index markets and strong Global Macro investment, trading and strategy background.