TradeTech Europe 2026

21 - 23 April 2026

RAI Amsterdam

Media Center

The xyt & TradeTech 2026 Report [Register your interest]

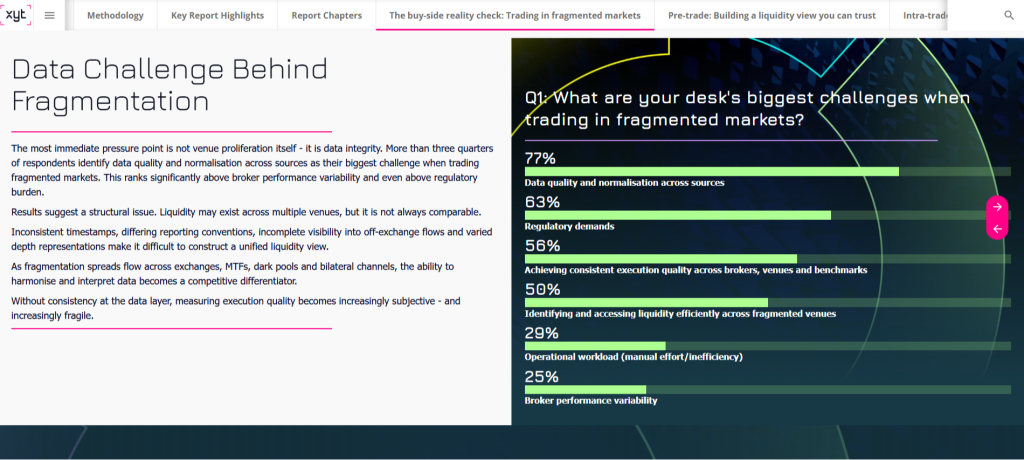

We surveyed 100 senior trading and market structure leaders across the buy side and sell side, in partnership with xyt. The survey explores how market fragmentation is impacting execution, where confidence breaks down in pre-trade liquidity assessment, how desks adapt strategies intraday, and how effectively firms can diagnose outcomes and learn from post-trade analysis. Together, the results highlight where execution teams are investing, the operational and data constraints they continue to face, and what best-in-class trading desks do differently.

TradeTech Europe 2025 - The Post Event Report

If you couldn’t join us in person - or if you want to relive the highlights - our upcoming post-event report captures many of the key moments and insights from across the 2025 event, including session recaps, thought leadership from some of the industry’s most forward-thinking voices, and the emerging trends set to shape the future of trading. Download your free copy today!

Navigating Risk Liquidity: Strategies for Trading Leaders

In Q2 of 2024, WBR Insights conducted a two-phase survey to understand the critical challenges faced by trading professionals. The report delves into three key areas identified by the survey: assessing risk in today’s market, navigating future liquidity trends, and exploring the latest innovations and technological developments impacting the trading landscape. Each section leverages the survey data and is enriched by expert commentary and analysis from industry leaders like Liquidnet and the TradeTech EU community.

Building The High-Velocity Front Office

This comprehensive guide reveals how leading institutional investors are transforming their front office operations. From AI-powered workflows and real-time data access to next-generation portfolio construction and seamless collaboration, discover the five breakthrough strategies reshaping investment management today.