Buy Side Speakers

Global Head, Trading

Janus Henderson Investors

Head of Electronic Trading & Services

Allianz Global Investors

Head of Trading

Federated Hermes

Digital Asset Partnership Development

Franklin Templeton

Head of Trading, EMEA

DWS

Global Head of Trading

UBS Asset Management

Equity Index Portfolio Manager and Trader

Vanguard

Head of European Equity Trading

Capital Group

Index Equity Portfolio Manager & Trader, Senior Specialist

Vanguard

Chief Technology Officer

Voloridge Investment Management

Global Head of Equity Portfolio Engineering & Trading

Abu Dhabi Investment Authority (ADIA)

Chief Investment Officer

M&G Investments

Global Head of Trading Research

Schroders

Global Head of Trading

Allianz

Chief Investment Officer, Core Investments

BNP Paribas Asset Management

Head of Systematic Trading & Research Analytics

Ontario Teachers Pension Plan

Head of Quantitative Trading

Norges Bank Investment Management

Global Head of Dealing & Implementation

M&G Investments

Global Head of Trading, Treasury Management and Global Solutions

HSBC Asset Management

Head of Investment Strategy

Lombard Odier

MD, Global Investment Strategist and Head of Macro Credit

Nuveen

Head of FX & Equity Dealing, EMEA

Aberdeen

Head of Dealing

Newton Investment Management

Head of Process Automation

Balyasny Asset Management

Head of Execution Technology

Man Group

Head of Order Management and Analytics

Man Group

Executive Director, Office of Government Affairs

Goldman Sachs Asset Management

Head of Equity Trading (London)

RBC Bluebay

Head of Trading

Jupiter Asset Management

Senior Executive Director, Trading Technology

JP Morgan Asset Management

Senior Trader

American Century Investments

Head of Data Sourcing

Capital Fund Management

Head of Global Market Strategy

Natixis

Head of Front Office Platforms

First Sentier Investors

Head of Execution

Rothschild & Co

Head of Dealing Teams, RBC BD

RBC Brewin Dolphin

Head of Artificial Intelligence

Anima SGR

Senior Equity Dealer

Royal London Asset Management

Head of Macro and Multi-Asset Portfolio Manager

Lombard Odier

Global Macro Portfolio Manager

Lombard Odier

Portfolio Manager - Volatility and Overlay Strategies

Ostrum

Global Co-Head - Capital Markets

Barclays Private Bank

Head of Equity Trading

Fiera Capital

Head of Trading

J.P. Morgan Personal Investing

Head of Trading

Banque Eric Sturdza Sa

Head of Execution Desk

Erste Group

Head of Artificial Intelligence

Degroof Fund Management Company

Global Head of Securities Execution

EFG Bank

Head of Global Equity Execution

Andra AP-fonden (AP2)

Principal, Head of Trade Support

Connor Clark & Lunn

Equity Trader

Nordea Asset Management

Deputy Head of Next Gen Research

Robeco

Senior Trading researcher

Robeco

Head of Government & Regulatory Policy, EMEA chez Citadel LLC

Citadel

Senior Trader

Allianz Global Investor

Head of Trading Platform Development

Bank Vontobel AG

Trader and Data Scientist

William Blair

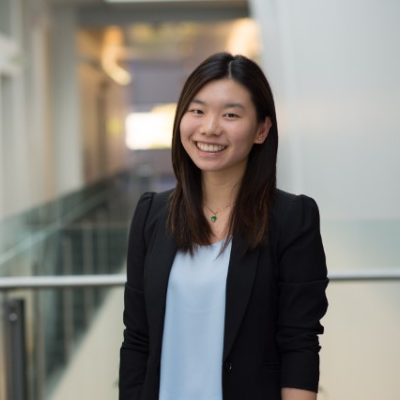

Head of Trading

Elo Mutual Pension Insurance Company

Senior Trading Data Analyst

Baillie Gifford & Co

Quantitative Trader

Norges Bank Investment Management

Partner & Head of Dealing

Skerryvore Asset Management

Multi-Asset Trading

Lupus alpha Asset Management AG

Head of Trading

CBH Bank – Compagnie Bancaire Helvétique

Head of Alpha Capture

Carlson Capital

Execution trader

Société Générale Luxembourg

Head Equities & ETD Execution & Sales

EFG Bank

Guest Speakers

Economist & Podcaster

Jim Power Economics

Professor of Computer Science

University of Bristol

Start Ups

Founder and Chief Executive Officer

3AI

Founder and CEO

RocketFin

Regulators and Policy Speakers

Head of the Capital Markets Union Unit, DG FISMA

European Commission

Head of Capital Markets Integrity Supervision

AFM

Director- Enforcement & Market Oversight

FCA

Consultants, Media, Associations

Founder & CEO

Streets Consulting

European ECM Editor

Bloomberg News

Managing Partner

Redlap Consulting

Advisor (ex-Man Group)

Independent

Secretary General

Arab Federation of Capital Markets (AFCM)

Managing Editor

Global Trading

Sell Side and Vendor Speakers

Global Head of Equity Execution Sales

Kepler Cheuvreux

Deputy CEO

London Stock Exchange Group

Head of Workflow Technology, EMEA,

Virtu Financial

Head of Market Structure, Europe

Susquehanna

Head of Product Marketing

Adaptive

Managing Director, Co-Head of Global Electronic Trading

BMO Capital Markets

Head of Equity Sales

Euronext

Chief Executive Officer

BCC Group International

CEO of Virtu Execution Services, EMEA

Virtu Financial

Global Head of Trading Platforms Product

Broadridge Financial Solutions

Head of ETF Secondary Market, EMEA

BlackRock

Chief Commercial Officer

xyt

Global Head of Business Execution, Low Latency

LSEG

Head Cash Market Products, Exchanges

SIX

Global Head of Equities Electronic Trading Sales

Barclays Investment Bank

Global Head of Distribution

XTX Markets

Associate Director of Product

ISS LiquidMetrix

Head of Equity Trading

Euronext

President

BCC Group International

Manager Director, Global Markets

BMO Capital Markets

VP, Data Analytics Consulting

EPAM

Managing Director Head of Liquidity, EMEA

Instinet

Founder & CEO

Imperative Execution / IntelligentCross

Head of ETF Trading Europe

RBC Capital Markets

Head of Equities

S&P Global

Global Head of Industry Specialists, Capital Markets

AWS

Market Structure Strategist

Jane Street

Head of Business Development, Exchanges, Market Infrastructure and Trading

AWS

Head of European Cash Equities

Cboe Global Markets

ETF Specialist

BNP Paribas

European Equities Product Management

Tradeweb

Chief Strategy Officer

Equiduct

Head of Institutional Equity Trading

EFG Hermes

Head of European Retail Trading

Optiver

Head of Broker Dealer Sales

OTC Markets Group

Head of Financial Derivatives – EQD & FI

Euronext

Managing Director, Head of European Market Structure

TD Securities

Manager Director, Global Markets

BMO Capital Markets

Head of Execution Services

Arqaam Capital

Chief Executive Officer

Optiver

Global Head of Buy Side

FIS

Front Office Strategy Director

FIS